Making Tax Digital 2025: Hits, Remixes & Your Tax Admin Glow-Up

- Jon Dell

- Jun 17, 2025

- 4 min read

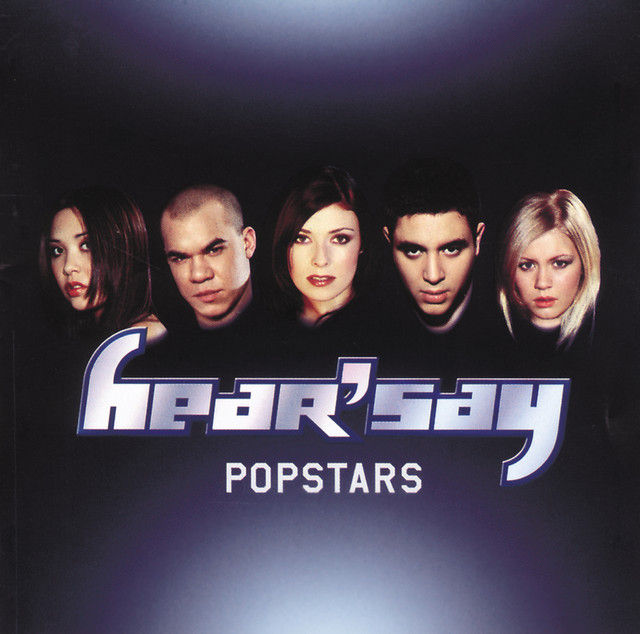

If Making Tax Digital (MTD) were a pop star, it’d be somewhere between Taylor Swift’s “1989 (Taylor’s Version)”and a surprise Beyoncé drop—long-awaited, headline-making, occasionally misunderstood, and constantly reinventing itself.

And like every good album rollout, the 2025 updates to MTD are packed with new features, slicker choreography (read: software), and a few curveballs to keep things interesting. So if you’ve been wondering what’s new, what’s next, and how to stay in harmony with HMRC, cue the spotlight—this is your backstage pass to the latest tax track list.

What Is Making Tax Digital (MTD)? The TL;DR Remix

For those new to the scene: Making Tax Digital is HMRC’s greatest hit in the making—a plan to move the UK’s tax system fully online. The idea is to make everything more accurate, timely, and efficient, using approved digital software.

If paper tax returns were cassette tapes, MTD is streaming on Spotify: modern, trackable, and (hopefully) less likely to eat your data halfway through.

MTD for Income Tax Self Assessment: The 2025 Re-release

You may have heard this one before, but this time, it’s really happening. MTD for Income Tax Self Assessment (ITSA)is preparing for its full public debut in April 2026, but the pilot program is the hot new single of 2025.

Who's on the Guest List?

If you’re self-employed or a landlord and your annual income is over £50,000, the MTD ITSA headliner tour kicks off for you in April 2026.

Those earning between £30,000 and £50,000 are part of the supporting act starting April 2027.

Earning less than £30k? You're in the VIP lounge for now, just watching the show.

Quarterly Updates: Four Seasons, Four Singles

Instead of waiting until January to drop one big tax return like Adele teasing an album for three years, under MTD you’ll release quarterly updates—a mini EP every three months showcasing your business performance.

It’s not a full performance (these updates don’t calculate your tax bill), but they help HMRC keep track of your greatest hits (and minor flops) throughout the year.

This also means you’ll have fewer year-end surprises. Think of it like having your manager check in with you after every gig, instead of waiting until the tour’s over and realising you accidentally played the wrong venue in Q2.

Digital Record-Keeping: Ditch the Mixtapes

Still storing receipts in a shoebox labeled “Misc 2023”? Time to upgrade your workflow. MTD requires that you keep digital records using compatible software.

The good news? There’s a whole chart-topping selection of MTD-approved tools to choose from. Whether you’re a solo act or a full accounting band, there’s software for every style—some minimalist, some with enough features to make Lady Gaga’s stage manager sweat.

If you’re emotionally attached to spreadsheets, you can still use them—with bridging software, which lets your beloved Excel sheet live its best digital life.

Pilot Scheme 2025: Auditioning for the Main Stage

HMRC is currently running a pilot program for MTD ITSA, kind of like a dress rehearsal before the big tour. Early adopters (aka the brave and organized) can test the system, provide feedback, and work out the kinks before the full rollout.

Think of it as your chance to be in the tax version of a secret Spotify listening party. You’re part of something cool before it goes mainstream.

Why This Isn’t Just Bureaucracy in a New Outfit

Sure, MTD means a few more to-dos on your calendar, but there’s method behind the rhythm. Here’s why MTD might actually make your business life a little smoother:

Real-time financial awareness – Stay on beat with your income and expenses.

Fewer errors – Auto-calculated figures mean less risk of off-key data.

Less stress in January – Spread your reporting like Ariana Grande spreads singles—strategically and often.

Penalties? More Like Dance-Off Rules

HMRC isn’t trying to pull a Simon Cowell here. They’ve introduced a new points-based penalty system, which is more forgiving than the old model. Miss a deadline? You get a point. Reach a certain number of points? That’s when the penalty drops.

It’s like having a few backup dancers mess up the routine—it’s not the end of the tour unless it keeps happening. Stay consistent, and you’ll never even hear the buzzer.

What’s Still in the “Coming Soon” Folder?

Like all great pop careers, MTD is evolving:

MTD for Corporation Tax is still in its demo phase—HMRC is writing the lyrics, but the release date isn’t confirmed.

Joint filings or expanded digital requirements for other income types may appear in future updates.

Software partnerships and new apps are popping up faster than K-pop subunits.

The digital tax universe is expanding, and it’s best to keep a metaphorical eye on the charts.

What Should You Do Now? Your Tax Tour Checklist

Whether you're self-employed, a landlord, or someone who just really enjoys staying ahead of compliance like it's the Billboard Hot 100, here’s your 2025 action plan:

Check your income level – Will you be joining MTD ITSA in 2026 or 2027?

Sign up for the pilot if you're ready for early access.

Choose MTD-compliant software – one that suits your level of glam, from basic beats to full production.

Get support – An accountant or tax advisor is like your tax choreographer. They keep everything in sync and ensure you don’t miss a step.

Final Chorus: Don’t Fear the Digital Disco

Making Tax Digital isn’t a villain in a tax-themed musical. It’s more like the background DJ helping you stay in rhythm—yes, there are new steps to learn, but with the right tools, you’ll be dancing through tax season like it’s a Dua Lipa concert.

So as we head into the MTD era, remember: the digital stage is set, the software is tuned, and the spotlight is yours. HMRC might not drop confetti cannons, but with smoother submissions, better tracking, and fewer last-minute panics, you might just find yourself humming a little tune every time you file a return.

Comments